This data brief accompanies updates to I-MAK’s Drug Patent Book database,1 which now includes nine of the drug products that formed part of the first Medicare negotiation list under the Inflation Reduction Act, as well as the products Ozempic, Rybelsus, and Wegovy (semaglutide) that have been included in the list of medications selected for the second round of negotiations. In this brief, we focus on the patenting and pricing practices for the products Eliquis and Ozempic, Ryblesus, and Wegovy (semaglutide).

Introduction

This brief examines the patenting and pricing practices in the U.S. for the drug products —Eliquis and Ozempic, Rybelsus and Wegovy (semaglutide).

Across our case studies for these drugs, we observe the following trends:

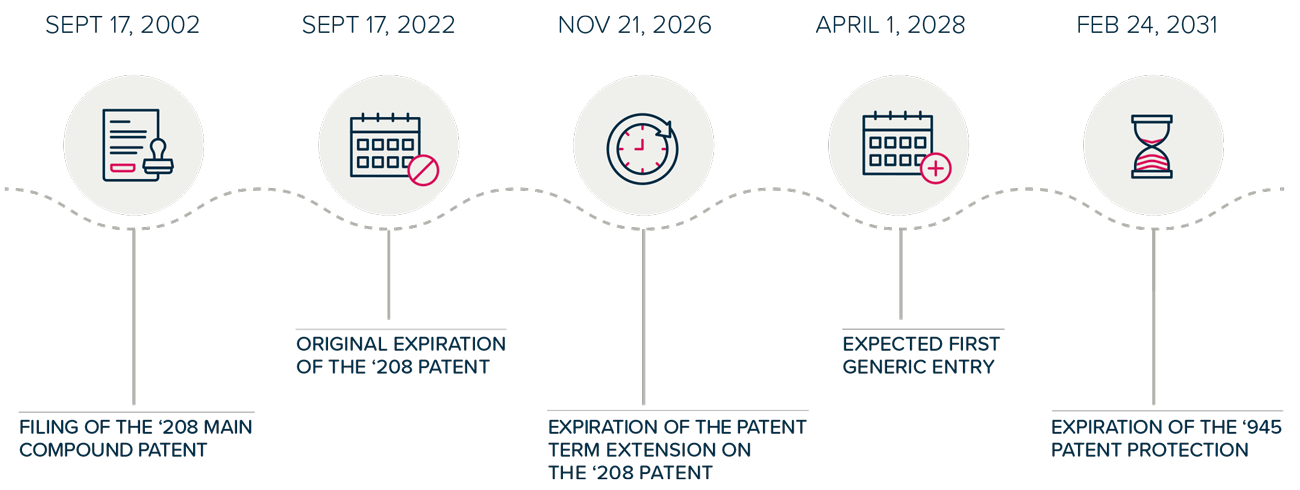

- Patent Term Extensions: Statutory Patent Term Adjustment (PTA) and Patent Term Extension (PTE) mechanisms delay the entry of generic medicines and add billions in additional revenue for blockbuster2 drugs, even before accounting for any extended market monopoly as a result of follow-on patenting.3

- Follow-on Patenting and Patent Thickets: In addition to being granted PTA and PTE, pharmaceutical companies seek numerous follow-on patents covering minor modifications of the original patented invention. These follow-on patents are used to build “patent thickets,” which are then selectively used in litigation to block generic competition or extract settlements that delay the entry of generics and lengthen market monopoly.

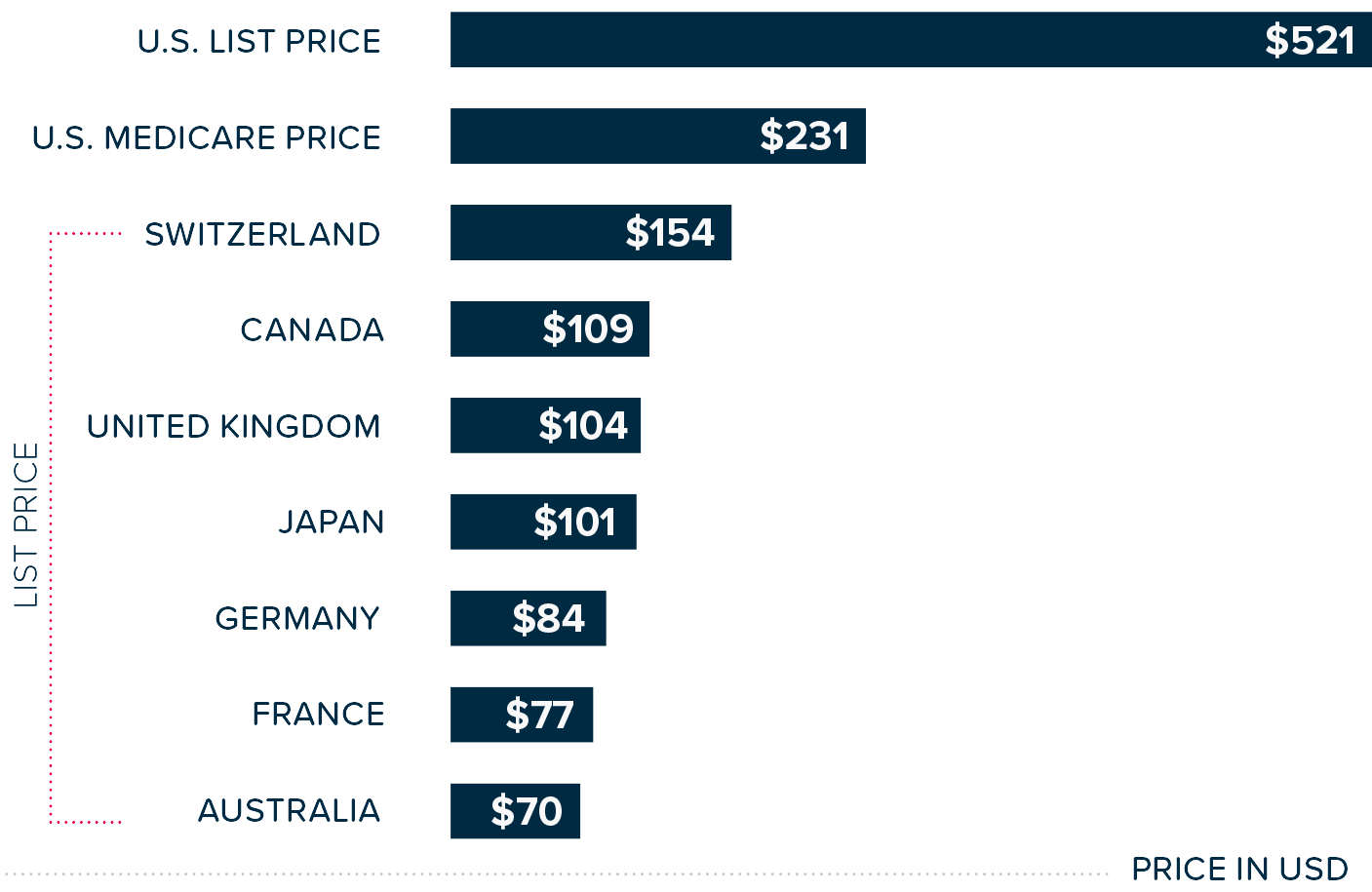

- Price Disparities: Dramatic pricing differences exist between the U.S. and other economically wealthy nations. U.S. patients often pay up to eight times more for identical medications, in part because other countries engage in more robust and often mandated pharmaceutical price negotiations that cover all patients and not just selected government programs.

- Delayed Generic or Biosimilar Competition: Patients in Europe, Canada, Japan, and other similar markets benefit from earlier generic entry compared to patients in the U.S., who have to wait years longer for low-cost generic products. The earlier generic entry can be attributed to how these countries’ patent systems are set up. This includes limiting the endless filing of continuation patents that are used to build large patent thickets. As a result, fewer patents would be granted and available for enforcement in litigation and the extraction of settlements.

- Economic Burden: The extended market monopolies extract billions of dollars in excess spending from patients, insurers, and taxpayers—money that represents profit beyond what was intended by the original social contract of the patent system.

Medicare drug price negotiation under the Inflation Reduction Act (IRA) represents a positive step toward curbing excessive market monopolies as a result of patent abuse and pricing disparities. However, it provides only a limited solution for a certain number of drugs and patients,4 while failing to address the root causes of patent abuse. Without comprehensive reform of the patent system and expanding drug price negotiations to the entire market, Americans that are not eligible for Medicare will continue to pay the higher prices for a longer period of time.

The following case studies provide analyses of how Bristol Myers Squibb and Pfizer (Eliquis) and Novo Nordisk (Ozempic, Rybelsus, Wegovy) have exploited the patent system, the financial consequences of these actions, and the stark contrasts in the prices of medicine and affordable access access between the U.S. and comparable international markets.

This analysis is part of I-MAK’s ongoing work to maintain and expand its Drug Patent Book database, providing policymakers, researchers, and advocates with evidence-based insights into pharmaceutical patenting practices, their implications on how much Americans have to pay for their medicines, and the need for systemic patent reform.